oregon workers benefit fund tax rate

OregongovdcbscostPagesindexaspx for current rate notice. For example The 2017-2018 rate is 28 cents.

People With Disabilities Demand Hike In Income Support Give Province Failing Grade Cbc News

165 cents per hour.

. Tax Formula Set Up. If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund WBF Assessment for each employee covered under. For 2022 the Oregon Workers Benefit fund rate remains at 22 cents per hour worked in 2022.

Tax rate increased more than 15. The 2022 payroll tax schedule is a. Employers and employees split the cost evenly 11 cent per hour worked.

Online Payroll Reporting System. Employers can deduct 11 cents per hour from employees if they choose to have employees pay a portion of the 22 cents per hour employer tax. Workers Benefit Fund assessment.

Workers Benefit Fund WBF Assessment Definition. You are required to report and pay the WBF assessment if 1 you have workers for whom you are required by Oregon law to provide. For example The 2017-2018 rate is 28 cents for each hour or partial hour and.

The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled and gives benefits to. 28 cents per hour. Line 10 of the.

Workers Benefit Fund assessment. When premiums started in 2019 04 of workers wages funded the program with 63 paid by employees and 37 paid by employers. 33 cents per hour.

These benefits are funded by State Unemployment Tax Act SUTA payroll taxes paid by employers as well as reimbursements from governmental and non-profit employers. Employers and employees split this assessment which employers collect through payroll. You are responsible for any necessary changes to this rate.

Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule three for the 2022 calendar year. What is the 2022 tax rate. Go online at httpswww.

No change remains at 22 cents per hour worked in 2022. The benefit fund assessment pays for return. Oregon workers benefit fund tax rate Thursday February 17 2022 Edit.

Wwwdcbsoregongov Testimony of DCBS Director Our Mission. WBF Assessment Rate Employers Portion Workers Portion. To protect and serve Oregons consumers and workers while supporting a positive business climate Workers.

ResourceWorkers compensation rate information. Tax rate increased more than 10 percentage point and not more than 15 percentage points will be eligible for 50 percent of their deferrable UI taxes forgiven. This assessment will decrease to 22 cents per hour worked for 2020 down from 24 cents per hour for 2019.

The assessment is paid directly to Oregons Employment and Revenue departments through quarterly payroll tax reports and the revenue is transferred to DCBS. 165 cents per hour. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessmen t is 22 cents per hour worked in 2022 unchanged.

The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers. What is the Oregon WBF tax rate. Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment.

The WBF assessment rate which varies from year to year is xxx cents for each hour or partial hour worked. Provides increased benefits over time for. For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years.

Oregon average pure premium rate changes Oregon workers compensation premium assessment rate Oregon Workers Benefit Fund cents-per-hour assessment rate Total loaded. The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour.

Embracing Environmental Social And Governance Esg For A Sustainable Future Mnp

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

Oregon Workers Compensation Division Do I Need Insurance Employer State Of Oregon

Permanent Disability Benefits Worksafebc

Workers Compensation Benefits And Your Taxes 2022 Turbotax Canada Tips

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

How Are Workers Compensation Benefits Calculated Foa Law

Pin On Legalshield Independent Associate

How Are My Workers Compensation Benefits Calculated Kbg Injury Law

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Smart Companies Will Increase Workers Compensation Due To Runaway Inflation

Workers Compensation Overview And Issues Everycrsreport Com

:format(webp)/https://www.thestar.com/content/dam/thestar/news/gta/2018/09/26/workers-groups-cry-foul-as-wsib-celebrates-financial-milestone/wsib.jpg)

Workers Groups Cry Foul As Wsib Celebrates Financial Milestone The Star

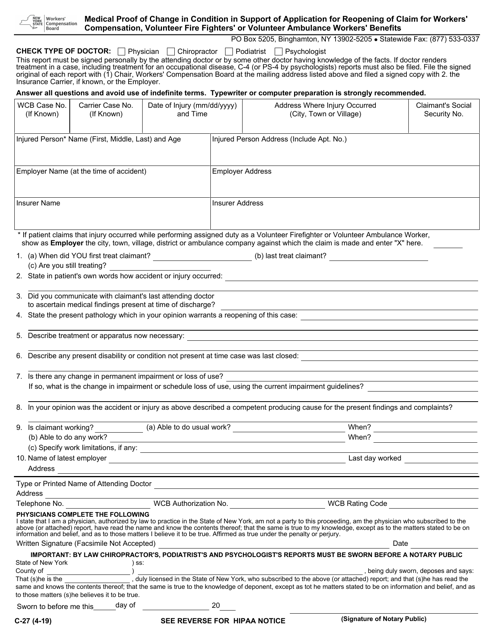

Form C 27 Download Fillable Pdf Or Fill Online Medical Proof Of Change In Condition In Support Of Application For Reopening Of Claim For Workers Compensation Volunteer Fire Fighters Or Volunteer Ambulance Workers